Our goal at Coca-Cola Europacific

Partners (CCEP)

1

is to create value

for all our customers through the

strength of our portfolio, our great

drinks and the quality of the

service we provide. Our operating

model is customer centric and

focused on delivering the best

service to our customers.

As the world’s largest independent

Coca-Cola bottler we work with a huge

range of customers – from the smallest

local convenience stores and cafés, to the

largest supermarkets and venues – from

national to regional accounts as well as

independent outlets, to get our great

products to our consumers.

As markets come out of COVID-19 and

the away from home (AFH) channels have

started to reopen, CCEP has been focusing

on supporting customers throughout this

transition period with field support coupled

with strong activation in outlets to help

drive footfall into customer outlets.

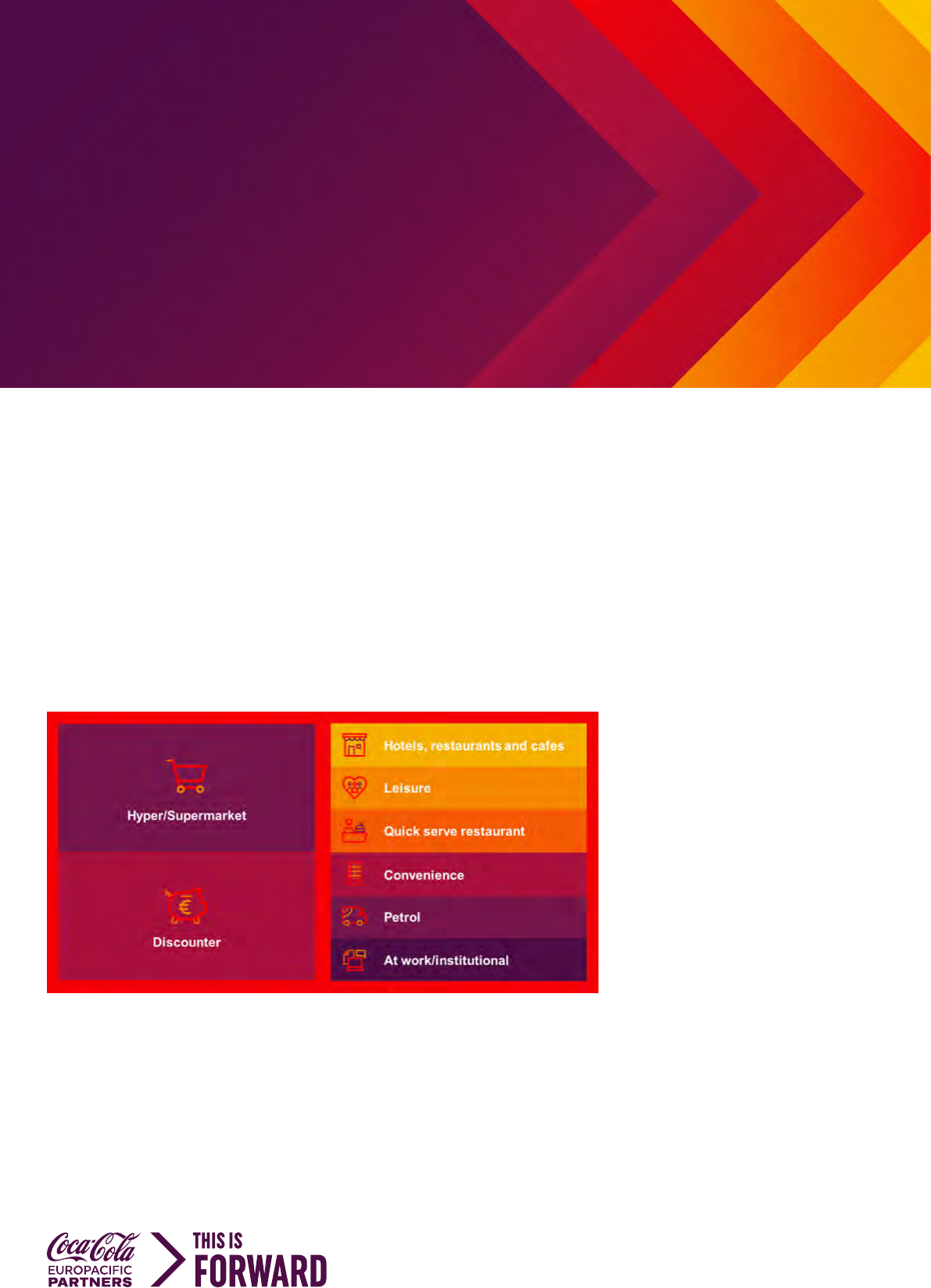

With such a wide array of customers from

retail to AFH, it is vital we take a bespoke,

channel-specific approach to serving

our customers. To enable this approach,

we think about our customers in the

following clusters:

Each of these different clusters requires a

different approach to enable our customers

to grow. Our customer partnership model,

with this segmented approach, allows us

to access powerful insights from customer

data which support tailored execution

plans. Customer data analytics allow us

to understand the challenges and

opportunities that our customers are

encountering. We can easily identify

development areas which will help us to

better serve our customers, partner and

capture growth opportunities.

As a result, we also use several different

measures to understand the quality of the

service we provide and how satisfied our

customers are.

CUSTOMER ENGAGEMENT

Customers are at the heart of our business,

and we work closely with them on many

different levels. Our frontline field sales

teams visit customers every day to support

them with in-store execution, while country

General Managers regularly engage with

customers on product strategy and

planning, along with senior members of

the sales teams.

1. In May 2021, Coca-Cola European Partners completed the acquisition of Coca-Cola Amatil, becoming

Coca-Cola Europacific Partners (CCEP). We are working to update our sustainability action plan targets

to cover our combined business, including Australia, the Pacific and Indonesia (API), by the end of 2022.

OUR APPROACH TO

MEASURING

CUSTOMER

SATISFACTION

Our approach to Measuring Customer Satisfaction | July 2022 | 1

MEASURING CUSTOMER

SATISFACTION

Our retail customers

Our retail customers include the shops,

stores and businesses that sell our drinks to

consumers for consumption later at home.

They represent a huge part of our business,

and we measure their satisfaction through

the Advantage Group Survey.

The survey covers 90% of our retail

customers

2

and asks them to rank CCEP’s

performance across a variety of critical

partnership areas including strategy,

operations, customer service, marketing,

innovation, people and sustainability.

We measure ourselves against our ambition

to be our customers’ number one supplier

within the beverage industry and fast-

moving consumer goods (FMCG). The

survey covers eight of our nine markets in

Europe (GB, France, Belux, Netherlands,

Germany, Sweden, Portugal and Spain).

Due to the impact of COVID, customer

requirements for support increased with

two markets (France and Germany) being

more challenging. In 2020, CCEP continued

to offer the support to customers and listen

to their needs.

In 2021, the CCEP cross-market score

rebounded back to 2019 levels; securing #1

positions within FMCG across GB,

Netherlands and Sweden:

Satisfaction KPI 2019 2020 2021

Average Customer

Ranking number

(from 1 to 15)*

on FMCG

5.8 6.5 5.6

* Average score from our EU markets where we

measure overall customer satisfaction (1=best

score).

2. ~20% in Germany.

3. NielsenIQ FY21 data for GB, France, Germany,

Belux, the Netherlands, Sweden, Norway, Spain,

Portugal, New Zealand and Indonesia. IRI FY21

data for Australia.

4. This data covers CCEP’s European markets only;

Source: NielsenIQ GTC FY21 data for GB, France,

Germany, Belux, the Netherlands, Sweden,

Norway, Spain and Portugal.

Our ‘Away from Home’ customers

The AFH channel refers to those customers

where consumers purchase our drinks to

enjoy at a venue or away from home. It

includes bars, restaurants and cafes as well

as workplaces and other institutions, like

schools and colleges.

To measure the satisfaction of our AFH

customers, we regularly engage with them

to gather feedback.

In 2019, we launched a satisfaction survey

among our AFH customers in Europe that

we cover with our field sales teams. The

survey aims to capture their expectations

and feedback regarding our commercial

approach. The insights we gather help us

to identify opportunities and enable us to

take the appropriate actions to enhance

customer satisfaction.

This survey helps us to:

– understand what determines a healthy

customer relationship in the AFH channel,

what drives superior customer experience

and the weight of the different factors

that influence it

– measure the health of CCEP’s relationships

with its AFH customers and the position

against key competitors in each market

– identify the critical moments in the

Customer-Supplier relationship and

the optimal contact channels

– define clear action points to achieve

a ‘simply brilliant’ customer experience

that drives Relationship Health

Due to COVID-19 restrictions we were

unable to complete a customer satisfaction

survey across the AFH channel in 2020.

Hence the results cover only 2019 and 2021.

In 2021, we extended the scope of the

survey to include all Spirits, Coffee and Beer

suppliers, including small local businesses.

In addition to the AFH customer

satisfaction survey, we also created a

bespoke survey for users of our European

AFH online customer portal to evaluate

their satisfaction and to understand how

they want to interact with CCEP using our

existing contact channels and the future

functionalities, services and solutions we

could offer as part of our technology

development roadmap.

The portal allows customers to easily and

quickly order our products, manage invoices

and contact us. The survey in 2021 covered

over 9,800 direct and indirect customers.

Of these customers, 80% indicated that

they were satisfied with their experience

of using the portal, and over 71% said it

made it easier to do business with us.

MEASURING VALUE

CREATION

Measuring value creation for

our customers

Creating value for our customers is a core

part of our business and one of our primary

objectives. We work with NielsenIQ and IRI

3

– retail and consumer data and insight

providers – to measure how much value

we create for our customers, and how our

individual brands support this value creation.

In 2021, across all our territories in Europe

and Australia, the Pacific and Indonesia

(API), we created €14.4bn in value across

our non-alcoholic ready to drink (NARTD)

categories for our customers in the Home

Channel, a year on year increase of €73 3m.

In Europe, CCEP has four brands appearing

in the top 10 NARTD brands ranked on

absolute value growth with Monster being

#2, Coca-Cola Zero #3, then Coca-Cola

Original Taste and Fanta.

4

Measuring how many customers

we visit each day

Much of our ability to create value for our

customers depends on the quality of the

service we provide and how we execute in

the market. Our focus in delivering this is to

ensure our frontline sales teams are visiting

and engaging with customer regularly –

which we measure by tracking the number

of customer visits we complete each day.

In Europe, we have about 1,500 sales

representatives in the AFH channel who

conduct 12-13 visits per day. This means

that we visit more than 18,000 accounts

daily and have more than 390,000

interactions with our customers on a

monthly basis.

In addition to our Field Sales teams, we

also interact with our AFH customers via

our call agents and digital teams, as part

of our Omni-Contact (Face, Voice and

Digital) strategy.

Within the Home channel, we have about

900 sales representatives covering 55%

of the retail outlets, with an average of 6.5

visits per day.

Our approach to Measuring Customer Satisfaction | July 2022 | 2