Highlights in 2019

• Continued improvement in customer satisfaction results and launch of new

customer satisfaction pulse survey

• Improvements in customer coverage, including time spent with customers,

with greater sales force specialisation to enable our 24/7 strategy

• Accelerated use of new technology, including connected coolers, sales force

automation, image recognition and web-based ordering

• Holistic approach to building growth capabilities, including revenue growth

management andkey account management, by defining prioritised actions

per capability

Priorities in 2020

• Leverage data and advanced analytics to improve segmented execution

• Step up in indirect partner management and data sharing

• Launch of new business developers’ academy to drive our sales force’s

capability to deliver improved customer service, performance and execution

and ensure successful onboarding for new business developers

• Strengthen our relationship with e-retailers and start deep partnering with

new channels to achieve higher market share online

• Launch of internal validation and certification process to share best practices

and accelerate the development of our prioritised growth capabilities

KPIs

• FX-neutral revenue

growth

• Volume growth

• FX-neutral revenue

percase growth

Stakeholders

Our customers

Shareholders

The Coca-Cola

Company

Risks

• Channel mix

• Geopolitical and

macroeconomic

• Quality

GROWTH PILLAR

WIN IN THE

MARKETPLACE

2

COCA-COLA HBC30

Route-to-market

approach

Our route-to-market approach is about

converting our strategy into excellent

execution at every point of sale. In line

with our improving portfolio, we are

continuously strengthening our route

to market and partnering with our

customers to bring our 24/7 portfolio

into the hands of our consumers faster

and with greater efficiency.

Our targeted and segmented way

ofserving our customers, with an

appropriate level of sales force

specialisation and combined with the

utilisation of new technologies, gives

us a competitive advantage to win

inthe marketplace.

Capturing growth opportunities requires more

than a strong product portfolio. It is equally

necessary to have excellence in execution,

successfully serving every customer through

every outlet for every occasion, 24/7.

Our success is dependent on the success of

our customers. When our customers are able

to generate profits by selling our products,

they demand more products from an

expanded range. Joint value creation is

therefore key to both category and market

share expansion as well as profitable growth.

There are two pillars underpinning our joint

value creation process: our next-generation

customer approach and our industry-leading

commercial capabilities.

Partnering with customers

Our next-generation customer partnership

model allows us to generate powerful insights

from customer data, which supports tailored

execution plans implemented in collaboration

with our partners. We start by commissioning

an annual survey of more than 16,000

customers, comparing ourselves with other

beverage suppliers. This survey allows us to

understand the challenges and opportunities

our customers are encountering, meaning we

can identify how to become better partners

and continue to exceed their expectations.

This approach is helping us to develop

stronger and more productive customer

partnerships and provides a platform for

ustocontinue building these relationships.

As a result of this model, in 2019 we were

recognised as the top supplier for traditional

outlets in three additional countries compared

with 2018. We increased our share of

satisfied customers by 2% to 68.6% in 2019,

and we maintained our high share of satisfied

key account customers at 81%.

We also launched customer pulse surveys

during the year to listen and respond to our

partners’ needs even more frequently. Pulse

surveys allow us to analyse satisfaction levels

by region, channel and outlet segment for a

more targeted response.

To optimise strategies undertaken together

with our customers, we are developing

morepowerful analytic tools to assess

commercial decisions and better understand

the investment and returns required.

Ourcustomers are also developing their

ownofferings.

The HoReCa channel remains a key focus,

asit is pivotal in driving premiumisation and

building the right consumer experience

around our brands. We leverage the expertise

of our centres of excellence in Croatia and

Greece to build a shared value proposition,

provide a bespoke service to our customers

and capitalise on available synergies.

Prioritising critical capabilities

forgrowth

The second pillar underpinning our growth is

our industry-leading commercial capabilities.

This includes a game-changing approach to

revenue growth management, which makes

our business more sustainable and profitable,

and excellent sales execution, which lets us

offer the right range of products and

servicesto our customers while remaining

cost competitive.

SR

CG

FS

SSR

SI

INTEGRATED ANNUAL REPORT 2019 31

By improving revenue growth management,

we aim to maximise value from every

transaction. Our new revenue growth

management framework, developed in

partnership with The Coca-Cola Company,

makes better use of big data and advanced

analytics, giving us deep insight across

different channels, customers and types

ofshoppers. This has led to fundamental

changes in planning, and it empowers our

markets to make the right strategic decisions.

In the last few years, we have continued

toexpand our portfolio and make it more

consumer centric, along with an increased

focus on consumer occasions. At the same

time, we have striven to improve category

and package mix, focusing on portfolio

premiumisation, brand stratification and

growing sales of single-serve packages.

These are all crucial to our revenue

growthapproach.

As an example, in Russia we created a plan

toaddress the challenges of low per-capita

consumption and overall affordability of

Coca-Cola products, combining consumer

insights, pack-price architecture and

promotions to create a compelling customer

selling story. One specific initiative was the

launch of a 900ml package size, which

successfully contributed to sales growth.

In Italy, we have successfully used pack-price

architecture to reverse declines in the

sparkling category and dilution of customer

margins. We launched several new packs

including a 660ml PET bottle with a €1 price

point as well as a new, smaller, 450ml pack for

on-the-go occasions. In addition, we

supported new multi-packs with value-based

promotions. These moves helped us unlock

opportunities for smart pricing which led to a

return of sparkling category value growth in

the market.

As our Revenue Growth Management

approach is analytically intensive, it requires

the right tools to be supported by our

systems. To embed this model, we have

equipped our business units with various

analytical tools which are fully integrated

withour digital environment. Our business

developers can now use advanced pricing

and assortment optimisation tools which

areallowing us to make the right

strategicdecisions.

Leveraging technology for better

execution

Our route-to-market approach converts our

strategy into excellent execution at every

point of sale. These efforts are increasingly

segmented, with implementation plans for

almost 300 initiatives across our markets.

Increasingly, new technology frees up time

needed by our sales force to focus on

channel and product specialisation.

We have equipped our sales teams with a

sales force automation tool, which helps our

people provide the very best service quality.

This platform uses a range of customer data,

including from connected coolers,

suggesting activities with the biggest impact

for each customer visit, and recommending

products and quantities to be ordered whilst

reducing administrative tasks.

We have increased our investment in coolers

over the past few years. Our cooler coverage

reached 87% of our top customer outlets by

the end of 2019, amounting to 1.43 million

coolers, of which 28% are energy-efficient.

This investment serves to drive immediate

consumption and increases revenue per

case. At the same time, we are building a

network of connected coolers, which are now

present in all of our 28 markets. This

technology automatically keeps track of

inventory and supports promotional

messaging to consumers within close range.

In order to improve our in-store execution we

have deployed image recognition

technology. In Italy for example, our

customers are incentivised through a loyalty

scheme to perform image recognition in our

coolers, ensuring the right presence for all

our product categories.

In 2019, we launched Coca-Cola Hellenic’s

first service brand, Qwell by Valser, for

delivery in Switzerland. The project includes a

web-based ordering platform and app, and

we have doubled the number of products

available since 2017. This effort is supported

by a cross-system team, in partnership with

The Coca-Cola Company, and supports

brand launches to fuel growth.

In 18 of our markets, we have improved

online ordering and self-service functionality

for customers with a solution that fully

integrates SAP platforms with Coca-Cola

HBC back-end systems. This streamlines

both ordering and processes for cooler

servicing, financial claims and order tracking.

In 2019, we expanded this solution to a total

of 12,000 customers. In 2020, our focus is on

expanding the rollout of this solution to

additional markets and further improving

customers’ online shopping experience with

options for email marketing campaigns and

product proposals.

Win in the marketplace continued

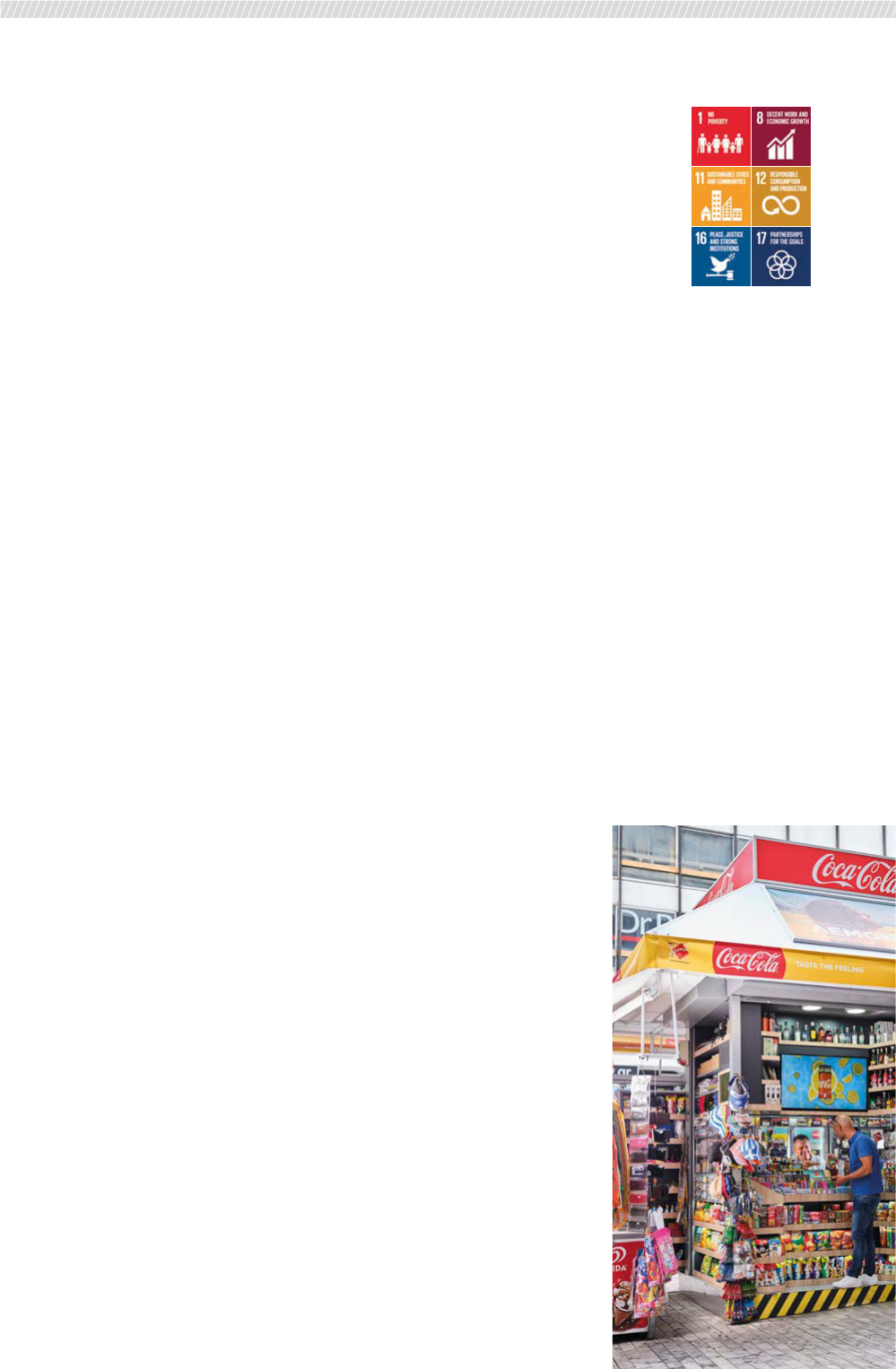

UN Sustainable

Development Goals

As we build our business by

helping our customers to grow

and thrive, we make substantial

contributions to the

achievement of the Sustainable

Development Goals related to

ending poverty, decent work,

sustainable communities,

responsible production,

justiceand strong institutions,

and partnerships.

32 COCA-COLA HBC

By offering a broader portfolio, with a wider

choice of products, we grow our business

and those of our customers. In established

categories, new recipes, variants and

packages are having a strong impact, while

initiatives for new categories are the basis for

long-term success.

With every initiative, we are focused on

growing the value of our portfolio. For

example, Coca-Cola Energy yields four

timesthe net sales revenue per unit case

compared to the non-alcoholic ready-to-

drink average. For our customers, this

represents increased revenue incremental

tothe overall energy category.

Additionally, we have launched an internal

innovation platform with 6,600 employees

currently engaged in the scheme. This is a

hub for our employees to share their ideas,

and so far, we have generated more than

4,700 ideas.

We also engage with external parties in our

quest for innovation, partnering with leading

universities and start-ups.

Big data and advanced analytics

As we seek to become more innovative and

customer-centric, we are leveraging our data

and investing in advanced analytic tools to

identify and capture value creation and

improve our service and operations.

In Nigeria, where trade is very fragmented,

advanced analytics have given us the ability

tosegment our outlets to the same degree

we had previously achieved in our other

markets. This allows us to have different

activations for different outlet segments,

addressing different drinking occasions. In

Lagos, for example, we were able to target

the Easter occasion in outlets near major

churches, with additional premium products

in more affluent areas.

We aim to build and sustain this critical

capability as a long-term competitive

advantage.

Data and advanced analytics techniques are

also supporting our segmented execution

model, providing suggested activities to our

sales force, including recommended orders

with specific products and quantities to

minimise out-of-stock incidents.

Building customer-centric

capabilities

To improve our efforts to partner with our

customers to drive mutual revenue and profit

growth, we have developed a new framework

for end-to-end customer management.

Weare also training and developing the next

generation of key account leaders as we

continue to evolve into an even more

customer-centric business.

To accomplish this, we have put in place a

robust programme of training backed by a

targeted development centre to address skill

gaps and ensure our people have the right

capabilities to take our customer partnerships

forward. As an example, we are setting up

dedicated negotiation rooms in each market

for our teams to practise and build their

negotiating skills, ready to meet our

customers’ expectations.

We are investing in improving leadership skills

and intensifying the involvement of leaders in

talent development. We have also launched a

simplified people-powered process for

performance and talent management which

incorporates regular feedback from peers

and customers. This is part of our effort to

improve employee experiences, with

increased focus on hiring, onboarding and

career discussions.

Disciplined innovation

As we become the leading 24/7 beverage

partner, we are unlocking growth potential in

segments outside our core sparkling portfolio.

New product launches accounted for 4.2pp

of our volume growth in 2019, the result of

our disciplined approach to innovation.

Sales force specialisation

By segmenting our customers and

introducing dedicated sales teams

specialising in specific channels, we are

unlocking the potential of our 24/7 portfolio.

We start by understanding the total universe

of outlets, defining different service levels

and contact options and optimising

customer visits by channel and segment.

Thisprocess helps us determine the right

level of specialisation so that we deploy the

right number of business developers. In big

cities, we have launched dedicated teams

serving HoReCa key accounts and

wholesalers, as well as ambassadors for

coffee and premium spirits.

Meanwhile, our business developers in rural

areas are responsible for a mix of customers

and products.

In Italy, over half of the beverage revenue in

the country comes from out-of-home

consumption, but just over a third of our

revenues in the market come from this

channel. We have addressed this with a

specialised sales force, supported by digital

prospecting tools, adding 34,000 high

potential outlets to our business developers’

routes. Since we began this approach in

2017, we improved our coverage from 23%

to 51% by the end of 2019.

Our tailored approach for the emerging

e-commerce and at-work channels supports

product cross-selling.

We are pleased with the results we have

achieved, through customer segmentation

and sales force specialisation. Our outlet

coverage was up 6% to 68% in 2019 and time

with customers up 3% in 2019 compared to

the prior year.

“

BY SEGMENTING OUR

CUSTOMERS AND

INTRODUCING DEDICATED

SALES TEAMS SPECIALISING IN

SPECIFIC CHANNELS, WE ARE

UNLOCKING THE POTENTIAL

OF OUR 24/7 PORTFOLIO.“

SR

CG

FS

SSR

SI

33INTEGRATED ANNUAL REPORT 2019